Comstock Holding Companies, Inc. (CHCI): An Asset-Light Cash Machine with a Governance Twist

How a little-known DC real estate manager generates remarkable profits without owning a single building

TL;DR

The Numbers That Matter:

Market Cap: $101M

P/E Ratio: 6.62x

ROIC: 29%

Cash: $28.3M

Debt: $6.05M

CHCI is a small-cap company trading at around 101 million market-cap on NASDAQ. They pivoted from being a real estate developer to a fee-based asset manager with this really unusual structure that's worth looking at. Since they made this switch to an asset-light model back in 2018, CHCI's been delivering better margins year after year and pretty predictable revenue, mostly from managing Comstock Partners' growing portfolio of mixed-use properties around Washington D.C.

The catch? Insiders Christopher Clemente and Dwight Schar control both CHCI (each owning like 31%) and separately own this private Comstock Partners entity that gives CHCI about 97% of its revenue through this long-term management agreement. This creates both some unusual stability but also some pretty obvious governance risks that explain why CHCI trades cheaper than similar companies despite having really solid financials.

With a bunch of projects in the pipeline that could double the portfolio they manage, CHCI looks like an interesting risk/reward setup for investors willing to bet that the insiders' interests stay aligned with public shareholders.

Company Overview & Structure

CHCI operates as this fee-based real estate manager focused exclusively on the Washington D.C. metro area, particularly around transit hubs in the Dulles Corridor. What makes CHCI really interesting isn't just this regional focus, but this unusual ownership structure and business model they've got going.

The company is basically controlled by two guys: founder/CEO Christopher Clemente and this real estate veteran Dwight Schar, who each own around 31% of CHCI's shares. These same two individuals separately co-own (50/50) the private company Comstock Partners, LC ("CP"), which owns the actual real estate assets that CHCI manages.

The key structure simplified:

• Public company (CHCI) - manages properties, earns fees

• Private company (CP) - owns actual real estate

• Same two people control both companies

• Long-term contract between them runs until 2035

• 97% of CHCI revenue comes from this arrangement

This creates a critical distinction that most investors miss: CHCI doesn't own real estate—it manages it for CP under this long-term Asset Management Agreement that runs through 2035 and auto-renews. This arrangement accounts for a crazy 97% of CHCI's revenue, making the company essentially a "public wrapper" for managing properties privately held by its own insiders.

The governance implications are pretty big. Clemente and Schar effectively control both sides of the primary business relationship—the public manager (CHCI) and the private asset owner (CP). While this creates remarkable revenue stability for CHCI, it also raises obvious questions about potential conflicts of interest.

If you're interested in exploring stock opportunities like CHCI., check out “Micro/Nano Real Estate Stars“ stock screener here.

Transition from Asset-Heavy to Asset-Light

CHCI's current business model came from this major restructuring back in 2018 that fundamentally changed the company's risk profile. Before 2018, CHCI operated as a traditional real estate developer and owner, directly developing and holding properties on its balance sheet. This approach, while potentially more lucrative in good times, exposed the company to significant downside during market downturns—as seen during the 2008-2010 recession where they really struggled.

The 2018 restructuring marked a decisive shift. Rather than a traditional "sale" with a large cash payment, CHCI effectively transferred its development assets to CP (Comstock Partners, LC) as part of a broader restructuring. In exchange, CHCI secured a long-term Asset Management Agreement (AMA) that would provide ongoing fee revenue through 2035. This wasn't a cash windfall transaction, but rather a strategic separation where CHCI traded direct ownership for long-term management rights and fee income.

The motivation was pretty clear: to reduce capital risk, stabilize earnings, and leverage recurring fee income without the balance sheet exposure of direct ownership. As the 10-K confirms, this move allowed CHCI to "operate a fee-based, asset-light, and substantially debt-free business model that allows us to substantially mitigate risks that are typically associated with real estate development and operation."

This transition makes comparing financial results pre-2018 and post-2018 somewhat misleading. The company essentially reset its business model, trading higher potential returns (and risks) for more predictable, stable income streams.

Financial Highlights

Income Statement Trends

Since completing its transition to the asset-light model in 2018-2019, CHCI has demonstrated impressively consistent financial growth. Revenue has climbed steadily year after year, from $25.3 million in 2020 to $51.3 million in 2024, representing a CAGR of approximately 18%.

More importantly, this growth has come with expanding margins. Net income has grown even faster than revenue, from $2.08 million in 2020 to $14.6 million in 2024, representing a CAGR of approximately 48%. Q1 2025 results continue this positive trend, with revenue up 18.8% year-over-year to $12.64 million and net income increasing by 74.7% to $1.59 million.

The consistent upward trajectory in both top and bottom lines reflects the scalability of CHCI's asset-light management model, where additional revenue flows through to the bottom line at increasingly attractive margins.

Share Issuance

One less positive trend has been CHCI's consistent share dilution. Share count has increased from approximately 6.6 million in 2019 to nearly 9.85 million by 2024, representing roughly 50% dilution over that period. This steady increase in share count has muted some of the earnings-per-share benefits that would otherwise have accrued from the company's strong profit growth.

The company has used equity for various corporate purposes, including employee compensation and strategic investments. While dilution is never ideal for existing shareholders, it has enabled CHCI to maintain a conservative balance sheet while still supporting growth initiatives.

Revenue Diversification

While CP remains the dominant source of CHCI's revenue (97%), the company has made efforts to diversify its income streams within this relationship. The fastest-growing segment has been ParkX Management, CHCI's parking management subsidiary, which has seen substantial increases in both the number of facilities managed and total revenue contribution.

The asset management agreement itself provides multiple revenue streams, including:

Basic asset management fees (2.5% of asset value)

Property management fees (1% of managed value)

Development and construction management fees

Leasing and financing fees

Performance-based incentives tied to asset performance

This diversity within the primary customer relationship provides some buffer against fluctuations in any single revenue category.

Balance Sheet Strength

One of the clearest benefits of CHCI's asset-light model is its rock-solid balance sheet. The company has minimal debt relative to its cash position, with cash reserves growing to $28.8 million by the end of 2024. Current assets of $34.80 million dwarf current liabilities of just $3.27 million, yielding a current ratio of approximately 10.6 as of Q1 2025—an exceptionally strong liquidity position.

This financial strength gives CHCI substantial flexibility to weather economic downturns or potential disruptions while maintaining the ability to invest opportunistically in growth initiatives.

Free Cash Flow

CHCI's business model naturally generates strong free cash flow, with minimal capital expenditure requirements. The company's FCF has generally tracked net income closely, with occasional variations due to working capital movements or financing activities during the 2018-2019 transition period and in 2022.

The asset-light approach means CHCI doesn't need to invest heavily in property acquisitions or major development costs, allowing most of its earnings to convert efficiently to free cash flow that can be used for shareholder returns or additional investments.

Peer Comparison Table

When benchmarked against similar fee-based real estate management firms, CHCI presents an interesting value proposition. Despite having one of the smallest market capitalizations in its peer group (approximately $101 million), the company delivers margins that exceed many larger competitors.

CHCI's EV/EBITDA ratio is comfortably in the single digits, comparing favorably to peers with similar business models. For instance, compared to companies like JOE, CHCI trades at roughly half the EV/EBITDA multiple.

The price-to-book ratio appears somewhat elevated, but this is largely an artifact of CHCI's asset-light approach—there simply isn't much book value for the multiple to reflect, unlike traditional real estate companies that carry significant assets on their balance sheets.

Net profit margins and return on invested capital metrics also stand out positively compared to the peer group, highlighting the efficiency of CHCI's operating model and its ability to generate substantial returns without tying up large amounts of capital.

Contracts, Assets & Growth Prospects

The cornerstone of CHCI's business model is its long-term Asset Management Agreement with CP, which provides remarkable revenue stability through 2035 and beyond due to automatic renewal provisions. The contract offers CHCI the higher of either:

Cost-plus: Reimbursement for all management costs plus a fixed $1 million annual profit

Market-based: Standard industry fees (asset management, property management, incentives)

This "better of" structure ensures CHCI maintains attractive margins regardless of market conditions. Additionally, the contract includes substantial termination penalties, making it highly unlikely that CP would end the relationship prematurely.

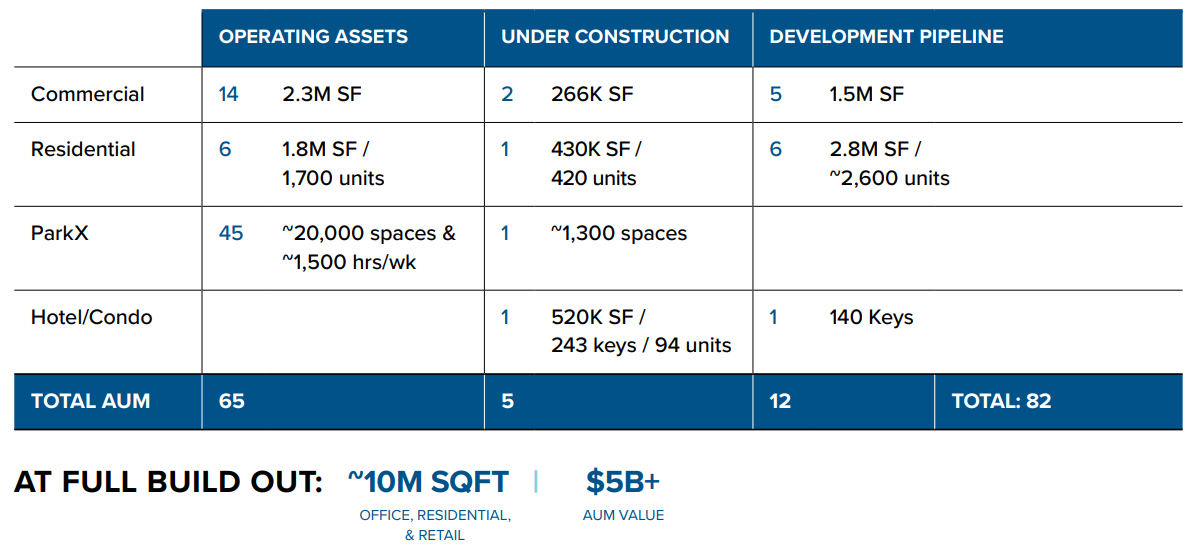

CHCI's future growth is directly tied to CP's asset expansion. Currently, CHCI manages approximately 2.3 million square feet of commercial space, along with residential and parking facilities. The development pipeline is robust, with projects underway that could potentially double the current portfolio size.

Coverage: "Under-the-Radar" Situation

It's kind of surprising, but despite its consistent financial performance and unique business model, CHCI receives virtually no analyst coverage from major Wall Street firms. This lack of institutional attention creates both opportunities and risks for investors.

On one hand, limited coverage contributes to potential market inefficiencies and valuation discounts that opportunistic investors can exploit. On the other hand, it means less scrutiny of the related-party transactions that dominate CHCI's business model, potentially allowing governance issues to go unexamined.

The company's small market capitalization and concentrated insider ownership further contribute to its under-the-radar status, with limited float and trading volume deterring larger institutional investors despite the compelling financial metrics.

Valuation Analysis

Looking at CHCI from a valuation perspective, this company immediately jumps out as potentially undervalued compared to peers in the real estate management space. The numbers tell a pretty compelling story right off the bat:

• P/E Ratio: 6.62x (way below industry averages)

• ROIC: 29% (impressive efficiency)

• Cash: $28.3M (solid reserves)

• Debt: $6.05M (minimal leverage)

These are the kind of metrics I look for in a value stock - strong returns, healthy balance sheet, and a low multiple. The cash-to-debt ratio is particularly attractive here, giving the company flexibility in an uncertain market.

For my analysis, I focused on discounted cash flow (DCF), which makes the most sense here given the company's model and consistency. I work through bear, base, and bullish cases, using a pretty conservative 15% discount rate—higher than the typical weighted average cost of capital, since I always want a premium over S&P 500 returns to justify taking on more risk in a single stock.

I don't get caught up in debates about whether the discount rate should be 7% or 9.5% - that's overthinking it. I use 15% as my hurdle rate because that's what I want as my minimum return for taking on single-stock risk. If a company can clear that bar, it's worth considering.

Here's how my DCF analysis breaks down:

For the bear case, I use initial free cash flow of $10 million (which is actually lower than their latest TTM FCF, with prior years at $9-11M), a 5% five-year growth rate, and a 3% terminal rate—assuming basically no new project success and just steady organic growth. Even here, I get an IRR of around 15.5%, which is still solid.

The base case uses a more realistic $13M in free cash flow (based on their recent performance), a 10% five-year growth rate (in line with their active pipeline), and a 5% terminal rate. That scenario gives a 22.5% IRR and a 50%-plus upside at my discount rate—very compelling.

For the bullish case, I used $15M in free cash flow, with 20% five-year growth (which doesn't feel out of reach based on their projects and track record), and a 5% terminal rate. That case delivers a 30% IRR and over 100% upside at the 15% discount hurdle.

Bottom line: The DCF across all scenarios shows a really attractive risk/reward setup. Even the bear case looks good, and the base and bullish scenarios look excellent—especially with current free cash flow at $13 million and a $100M market cap. My main caveat is the risk of further share dilution, given the company's history of issuing new shares, though this has slowed a lot recently. Management owns 60%+, so it would actually make sense to see share buybacks in the future instead.

The primary reason for CHCI's valuation discount seems to be those governance concerns we talked about earlier—the concentrated insider control and related-party dependency. But looking strictly at the business fundamentals and cash flows, there's a lot to like here at the current price.

Stock Price Performance

CHCI's share price has demonstrated strong momentum over the past year, appreciating approximately 40% as the market has begun to recognize the company's consistent execution and improving financial metrics. This recent performance outpaces many traditional real estate companies that have struggled with higher interest rates and market uncertainties.

Over a five-year timeframe, the stock shows more volatility, with significant swings during the pandemic period but an overall positive trajectory that has accelerated in recent quarters as the benefits of the asset-light model have become more apparent in a challenging real estate environment.

The stock's historical volatility likely reflects both its small market capitalization and the market's evolving understanding of CHCI's unique business model rather than fundamental operational instability.

Conclusion

CHCI presents investors with a fascinating investment case that combines compelling financial metrics with distinct structural risks. The company's strategic shift to an asset-light, fee-based model has successfully delivered the intended benefits: stable, predictable revenue growth, expanding margins, and a fortress balance sheet with minimal capital at risk.

The company's deep focus on the Washington, D.C. metropolitan area, particularly transit-oriented developments, positions it well within a robust regional market with significant long-term growth potential. The management team's extensive experience and insider alignment (through significant ownership stakes) further strengthen the investment thesis.

However, potential investors must carefully weigh these positives against the governance concerns inherent in CHCI's structure. The extreme concentration of revenue from related-party transactions and the dual control of both public and private entities by the same individuals creates potential conflicts that justify a valuation discount relative to peers.

For investors comfortable with these structural characteristics, CHCI offers an attractive risk-reward proposition at current valuations. The combination of predictable fee revenue, substantial growth pipeline, expanding margins, and financial strength creates a compelling case for a company that remains largely under the radar of mainstream investors.

Great discovery and fantastic write up