Don't Underestimate the Power of Buybacks

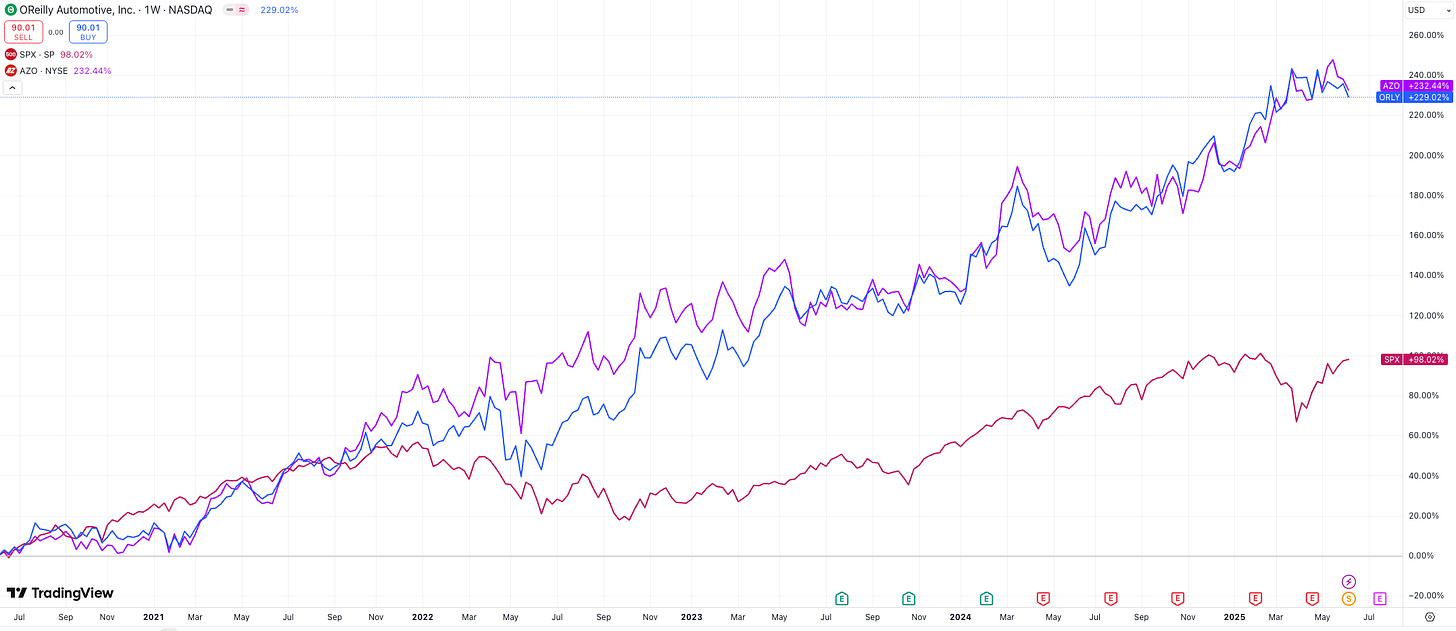

How two auto parts giants quietly delivered identical 230% returns while everyone chased tech stocks

TL;DR

AutoZone and O'Reilly Auto Parts have delivered nearly identical 5-year returns (~230%) through a simple but powerful strategy: consistent revenue and net income growth combined with aggressive share buybacks. Both companies increased revenues at 7%+ CAGRs while reducing share counts by 28-36%, creating a masterclass in capital allocation that has dramatically outperformed the S&P 500 with significantly less volatility.

Introduction

This substack isn't going to be my typical deep dive write-up about a net, micro, or small cap company that I think is being overlooked by the market. This post was inspired by curiosity and fascination with an important concept and strategy employed by leadership across public companies.

I recently stumbled upon AutoZone, and for some reason ended up looking at the five-year chart. I was dumbfounded by the impressive up-and-to-the-right behavior, along with the lack of volatility. My curiosity struck me for a couple of reasons: How have I overlooked this company? Obviously investors haven't overlooked it - it's a 60+ billion market cap company. But how is it not talked about all the time?

We're talking about a five-year return of almost 230%, which inspired me to take a deeper dive. The next interesting thing that happened while doing my initial research was during a competitor analysis - something I commonly do - I stumbled upon O'Reilly Auto Parts.

What I discovered was almost comical: how similar these companies are. They have similar market caps, similar metrics in general, and the price appreciation is almost identical. O'Reilly has a five-year return of 228.52% and AutoZone has a five-year return of 229.85% at the time of reviewing the data (6/11/2025).

This fascinated me - seeing this shared price appreciation between two "boring" companies, but more importantly, how oddly similar they are in share price appreciation and the methodology of how they achieve that. As the title says, this story revolves around the power of income statement growth - revenue and net income - combined with meaningful and consistent share buybacks.

If you're interested in exploring stock opportunities like AZO or ORLY., check out stock screeners here.

Company Introductions

AutoZone (AZO) AutoZone is the largest retailer of aftermarket automotive parts and accessories in the United States, operating over 7,500 stores across the US, Mexico, and Brazil. The company follows a "hub and spoke" distribution model, with regional distribution centers supporting clusters of retail locations. Their business model focuses on serving both DIY customers and commercial accounts, with a significant emphasis on inventory management and rapid product availability. Management has consistently executed store expansion domestically and internationally while maintaining their aggressive share buyback program. The company's strategy centers on leveraging their scale advantages and superior inventory turnover to generate strong cash flows, which they systematically return to shareholders through buybacks rather than maintaining large cash positions.

O'Reilly Automotive (ORLY) O'Reilly Automotive operates as a specialty retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories across 48 states. With over 6,300 stores, the company serves both professional service providers and do-it-yourself customers through a similar hub-and-spoke distribution network. O'Reilly has built a reputation for superior customer service and product availability, supported by sophisticated inventory management systems and strategic acquisitions that have expanded their market presence. Like AutoZone, management has demonstrated a clear commitment to returning capital to shareholders through consistent share repurchases, funded by strong operating cash flows and strategic use of debt financing. The company continues expanding both domestically and internationally, viewing geographic expansion as a key driver of future growth.

Financial Overview and the Buyback Story

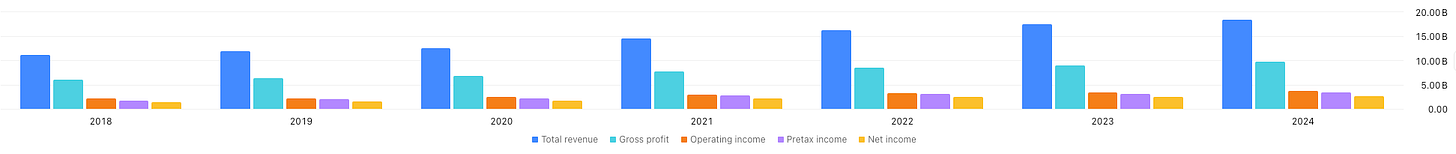

Let's start with the income statements. Looking at AutoZone's annual income statement going back to 2018, it's pretty easy to conclude that this company has performed incredibly well. Revenue, gross profit, operating income, and net income are all consistently increasing - clean up-and-to-the-right behavior.

The income statement is cleanly laid out with nothing confusing - no weird goodwill impairment costs, no funky business, no tax reimbursements. They've done a really good job maintaining a clean income statement that's very easy to understand from an investor's standpoint. Revenue has grown with a five-year CAGR of 7.92%, which is very impressive, consistent growth. Looking at future estimates and forecasts, we can expect similar growth with new stores expanding domestically and internationally.

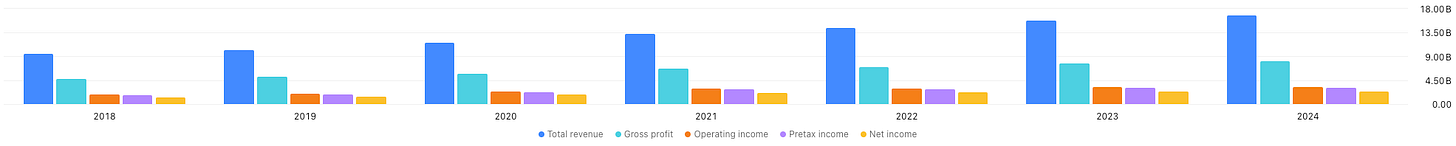

Next, let's jump to O'Reilly's income statement, which interestingly enough has both the scale and strength almost identical to AutoZone's.

As mentioned with AutoZone, all the important metrics - revenue, gross profit, operating profit, net income - show very consistent up-and-to-the-right behavior with no funky business going on. Looking at a 7.57% revenue CAGR, once again oddly similar income statements and metrics.

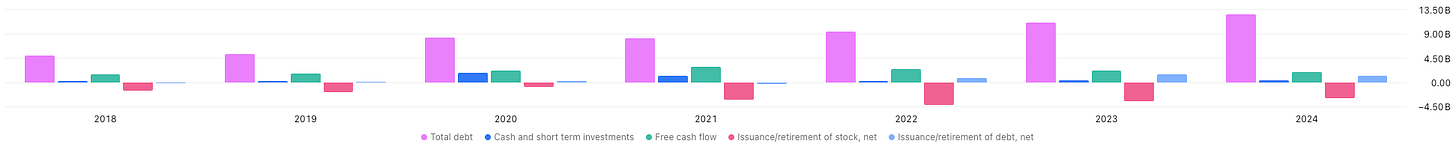

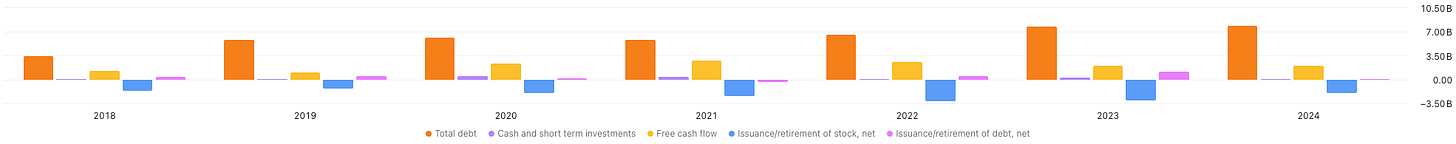

Now let's look at the balance sheet and understanding how they manage their cash. Looking at AutoZone first, there's a consistent trend that sticks out: their total debt increases every year. This definitely appears to be at a sustainable level - it's not acting like an actual concern, but it is something that jumps out. They don't keep a heavy cash position, and something that really sticks out is that their free cash flow is disproportionate to the share buybacks, meaning the buybacks are much more than the amount of free cash flow, especially for the last three years.

This tells me they're using a combination of cash holdings plus free cash flow plus debt to fund buybacks. Clearly, this company believes that share buyback returns will exceed the cost of debt.

Skipping to O'Reilly's balance sheet and cash flow, you'll see very similar behaviors. It's like the management of these companies got together and confirmed: "We're going to continue this strategy. Let's go all in together."

Very similar behaviors with debt trends up-and-to-the-right at similar magnitude levels. They also hold small cash positions, and the retirement of stock is funded by debt and free cash flow. Once again, very similar behavior where both companies believe the returns from buybacks exceed the cost of debt.

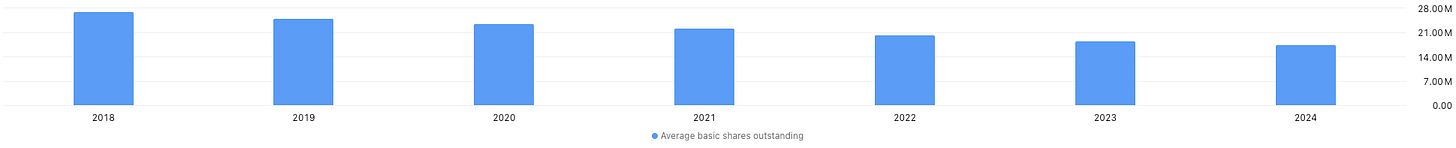

Now for the meat and bones - the actual share buybacks. Starting with AutoZone, looking at the share count from 2018 to 2024, we started with 26.79 million average shares outstanding and ended up with 17.31 million in 2024. Over that time, they decreased the share count by 35%, which is very impressive.

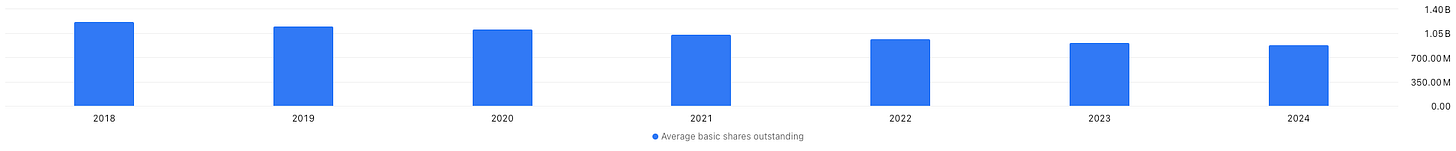

O'Reilly shows identical behavior. In 2018 they started with 1.22 billion shares, and by 2024 ended with 875.08 million, which is a decrease of 28% in share count - very impressive, though a little less than AutoZone.

What's remarkable is that despite repurchasing fewer shares than AutoZone, O'Reilly achieved the same stock price appreciation, which is also very impressive. It's very clear that this has been management's goal to focus on returning capital to shareholders, and it's a great example of how it can work when executed properly.

Comparison and Market Position

One of the interesting things to examine is the comparison analysis between these companies and their industry peers. Once again, it's sometimes like looking at a copy-paste situation - both O'Reilly and AutoZone have very similar market caps, enterprise values, trailing twelve-month revenues, P/E ratios, net margins, return on invested capital, inventory turnover ratios, and current ratios.

These similarities tell us the market has valued both companies almost identically, recognizing that they run virtually the same playbook. Their net margins hover around 14.4%, showing equally efficient operations, while their inventory turnover and current ratios demonstrate similar approaches to working capital management.

What's even more interesting is how they stack up against competitors. AutoZone and O'Reilly absolutely dominate the field - they're significantly larger than other players and convert revenue to profit far more effectively. The standout metric is return on invested capital, where both companies clock in around 38-40% versus single digits for competitors like GPC (9.79%) and LKQ (6.18%).

This ROIC dominance is crucial because it shows both companies are incredibly efficient at deploying capital. When you can generate 38%+ returns on invested capital, it makes perfect sense to keep buying back shares rather than chasing lower-return growth opportunities.

Valuation Challenges

One of my goals was to value these companies, but I'm finding it surprisingly difficult for several reasons. I typically start with a free cash flow DCF analysis, but these companies present some unique challenges.

Both are consistently generating free cash flow, but the conversion rates aren't particularly impressive. With revenues around 17-19 billion, they-re each producing roughly 2 billion in FCF - that’s only about 11% conversation rate.

Here's where it gets tricky: while the shrinking share counts are impressive, both companies are also steadily increasing their debt loads. O'Reilly carries about $8 billion in debt while AutoZone has around $12 billion. When you're simultaneously reducing shares and adding debt, it complicates the DCF math because you're essentially leveraging up the business to fund buybacks.

Looking at their P/E ratios (25x for AZO, 34x for ORLY), I can already tell a DCF isn't going to yield compelling results. In my experience, companies trading below 10x P/E are where you find the most attractive DCF outcomes, and I tend to be conservative with these analyses anyway.

This creates a valuation puzzle: the share price appreciation clearly stems from the buyback strategy rather than explosive operational growth. The thesis isn't that these are high-growth companies - it's that the combination of steady cash generation plus aggressive capital returns creates value over time. But that makes traditional valuation methods less useful since you're essentially betting on management's ability to continue this playbook rather than on underlying business acceleration.

Conclusion

These are two fascinating companies that demonstrate a crucial lesson: never underestimate the power of well-executed share buybacks. But here's the key - it's not just buybacks in isolation. It's buybacks coupled with consistent operational performance.

Quarter after quarter, year after year, both O'Reilly and AutoZone deliver roughly 7% revenue growth alongside similar net income growth. This consistency is what shareholders crave. When you can point to six years of reliable performance since 2018, it builds confidence that the strategy will continue working.

The international expansion adds another growth dimension. While geopolitical risks exist, expanding their total addressable market is a smart long-term play that extends their runway.

What's particularly interesting is how these companies' share price behavior differs from the broader market. Looking at chart overlays with the S&P 500, you'll notice significantly less volatility. During major drawdowns in 2022-2023 when Meta, Nvidia, and Amazon dropped 50-70)%, these auto parts companies held remarkably steady.

I believe this stability stems from their buyback strategy creating a support mechanism. When markets get volatile, management steps in to purchase shares, providing downside protection while maintaining shareholder confidence. It's a virtuous cycle - consistent buybacks reduce volatility, which attracts long-term investors, which further reduces selling pressure.

This represents a masterclass in capital allocation: grow the business steadily, return excess capital consistently, and create a track record that builds investor confidence. The result is exceptional shareholder returns with lower volatility than the broader market - a combination that more companies should study and potentially emulate.

One of my greatest regrets is selling both of these stocks a few years back. Waiting for a pullback that never happens.