Harmony Biosciences (HRMY): Hidden Gem or Value Trap in Rare Disease Pharma?

Harmony Biosciences Deep Dive: 35% Growth, 7.9 EV/EBITDA, and a Pipeline That Could Change Everything

TL;DR

Harmony Biosciences is a company I stumbled across when screening smaller pharma stocks. They're sitting at around a 2 billion market cap focusing on rare neurological diseases. Their main product WAKIX for narcolepsy has been driving solid growth - 35% revenue CAGR over the past few years with 25% net margins. The balance sheet looks clean with over 480 million in cash and very little debt.

What caught my eye is they're trading at around a 13 P/E ratio, which seems cheap for a company growing this fast. Most analysts have buy ratings with price targets around $51, but the stock's been sitting in the 30s. Either the market knows something I don't, or this is one of those situations where everyone's being overly cautious.

The main risks are obvious - they're basically a one-product show with WAKIX and dealing with some legal headaches. But the financials are solid and they're trying to diversify through acquisitions. Could be interesting if they can execute on their pipeline without tripping over the regulatory stuff.

Key Metrics:

Market Cap: $2.04B

P/E: 13.46

EV/EBITDA: 7.89

ROE: 24.71%

Current Ratio: 3.67

Debt/Equity: 0.29

Revenue Growth (CAGR): 35%

Net Margin: 25%

Summary

Harmony Biosciences is a pharmaceutical company that's been around since 2017, so relatively new in the pharma space. They're trading at around a 2 billion market cap on the NASDAQ. The company focuses on rare neurological diseases, which is honestly a niche that most bigger companies don't want to touch because the patient populations are small and the markets aren't huge.

Their main product is WAKIX for narcolepsy, and that's basically carrying the whole company right now. The drug got FDA approval back in 2019 and has been their cash cow ever since. What's interesting is they've been profitable for four straight years now, which you don't see that often with biotech companies. Most of them are burning cash for years before they make any money.

The financials actually look pretty decent when you dig into them. Q1 2025 showed 20% revenue growth year-over-year with around 185 million in net product revenue. They're converting about 33% of their revenue to free cash flow, which is solid cash generation. Plus they're sitting on over 480 million in cash with very little debt, so they're not exactly hurting for money.

The rare disease focus makes sense from a business perspective. These niche markets usually don't have a ton of competition, and you can get better margins. Plus the FDA gives you all these special designations that can fast-track your products to market. From a shareholder perspective, cash is king, and when you've got a steady stream of that coming in, it gets my attention.

They've been trying to diversify beyond just WAKIX through acquisitions. The Zynerba acquisition in 2023 brought some cannabinoid-based therapies into the mix, and their pipeline is starting to look more diverse. But let's be honest - they're still heavily dependent on that one product for now.

If you're interested in exploring stock opportunities like HRMY., check out stock screeners here.

Financial Review

Let me break down why I think these financials are actually pretty impressive. Looking at the revenue trends, we're talking about a 35% CAGR going back to 2020, and earnings growth has been even more ridiculous at 43% CAGR since 2021.

The transformation story here is solid - they flipped from unprofitable in 2020 to consistently profitable since 2021, and they've done nothing but improve the income statement since then. Nothing abnormal in the income statement other than some tax refunds in 2022. Over the past 3 years, margins have stabilized to around Gross Margin = 75%, Operational margin = 30%, net margin = 22-25%.

Balance sheet health is where this company really shines. The company has a healthy balance sheet that's stabilized in the last few years. Total debt position has consistently reduced year over year while the cash position has grown as well. With the company's healthy cash position and income, it sets them up to not have to issue debt or shares - all good signs for future success.

Share count stability is another thing I like. Share count hasn't really changed since they became public, which is good. I would prefer a company that buys back shares, but considering it's a company focused on growing, it's good they're not a mass diluter like some others. From what I can tell, there are no plans to buyback shares in the near future. With their healthy cash position, I don't see them needing to dilute the company to raise cash. All good signs.

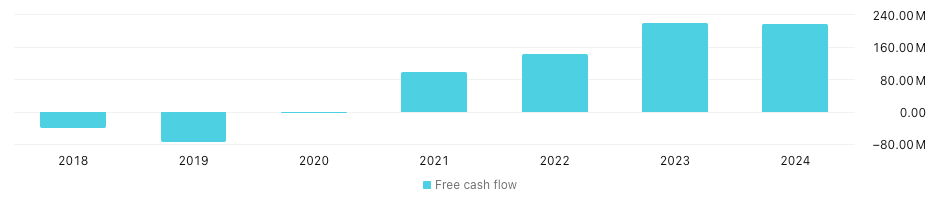

The free cash flow story is probably what gets me most excited. They've been able to convert around 33% of revenue (FCF/Rev) for the past 3 years - this is great FCF conversion. In 2021 they had $98M in FCF, and $218M in 2024, which is a 22% CAGR. With the consistent FCF conversion and growth, this lines up perfectly for a FCF DCF analysis.

Product Pipeline and Growth Potential

WAKIX® is still the star of the show, but Harmony's pipeline is getting more interesting every quarter. The Zynerba acquisition in August 2023 brought ZYN002 for Fragile X Syndrome, with registrational trial topline data expected in Q3 2025. That's potentially huge - Fragile X affects about 80,000 patients in the U.S. and there aren't many good treatment options out there.

Here's what's cooking in the pipeline and when we might see revenue impact:

Near-term catalysts (2025-2026):

ZYN002 (Fragile X Syndrome): Phase 3 data Q3 2025 - could start generating revenue in 2026 if successful. This could be the first approved treatment for FXS.

Pitolisant HD: New formulation to address FDA concerns about the original sNDA rejection. Phase 3 trials planned for Q4 2025 with potential PDUFA date in 2028.

BP1.15205 (Orexin-2 Agonist): Preclinical data presentation at SLEEP 2025 conference in June, with first-in-human study planned for Q3 2025.

Longer-term bets (2026+):

HBS-102 (MCHR1 Antagonist): Early clinical studies for Prader-Willi Syndrome, not general metabolic disorders.

EPX-100 and EPX-200: From the Epygenix acquisition, these are additional pipeline assets they picked up.

ZYN002 additional applications: They're looking at other cannabinoid therapy uses beyond Fragile X.

The timing here matters. ZYN002 data in Q3 2025 could be a major catalyst, and if successful, we could see revenue impact starting in 2026. The company expects at least one new product or indication approval per year through 2028, with up to six Phase 3 programs by end of 2025. The pipeline is projected to generate over 3 billion dollars in net revenue, so there's definitely some big numbers they're shooting for if things work out.

Risk and Competition

Let's be real about the risks here - WAKIX dependency is the big elephant in the room. This product represents the vast majority of their revenue, and while they have a decent chunk of the narcolepsy market, it's still a niche indication. From what I can tell, they hold less than 20% market share in diagnosed narcolepsy patients, so there's room to grow but also plenty of competition.

The legal situation isn't exactly helping either. There's some serious stuff going on with ongoing class action lawsuits that stem from a March 2023 report by Scorpion Capital. This report made some pretty heavy allegations about WAKIX - claiming it's unsafe, ineffective, and based on "sham patents" and "scam clinical trials". They also alleged Harmony engaged in "false advertising" and "kickback schemes" to physicians. The legal overhang from 2023 Scorpion Capital allegations continues to create uncertainty, though no major developments have occurred in the litigation. These aren't your typical business risks - fraud and misconduct allegations create multiple threats beyond just legal costs. The most likely outcome is a financial settlement in the $50-200M range (based on comparable pharma cases), but the reputational damage and prolonged uncertainty may be equally problematic. With securities litigation typically taking 4+ years to resolve, this overhang could persist well into 2027, creating ongoing headwinds for partnerships, product launches, and investor confidence.

On top of that, the FDA issued a "Refusal to File" on the pitolisant supplemental NDA for idiopathic hypersomnia in 2025, which was a setback. They're working on addressing the regulatory concerns with something called Pitolisant HD, but it shows the regulatory path isn't always smooth.

Competition-wise, the main rival is Jazz Pharmaceuticals, which has a dominant market share in narcolepsy with their sodium oxybate products like Xyrem and Xywav3. There are also 8 novel narcolepsy treatment candidates currently in clinical trials from other competitors, so it's not like they have the market to themselves.

The patent situation is something to watch too. Pitolisant's patent protection will eventually expire in the 2030s, though they might be able to extend that to 2044 with new formulations. R&D expenses jumped 56% year-over-year in Q1 2025, and general expenses rose 22%, so costs are climbing fast. With all the litigation going on, that could put pressure on their cash position even though they're sitting pretty right now.

Recent Developments

The past year has been a mixed bag for Harmony. On the positive side, Q1 2025 revenue and earnings beat expectations with continued strong financial performance. The company reaffirmed their 2025 revenue guidance of $820-860 million, showing confidence in their trajectory.

But it hasn't been all smooth sailing. The FDA refused the pitolisant/IH sNDA in early 2025 after a Phase 3 trial missed its primary endpoint. Instead of giving up, management pivoted to developing Pitolisant HD to address the regulatory concerns - that's the kind of adaptive strategy I like to see.

They also made some strategic acquisition moves. Zynerba was picked up in August 2023 for $60M cash plus up to $140M in milestones, and they grabbed Epygenix back in April 2024. Leadership additions include Ron Philip joining the Board in April 2025 and Adam Zaeske getting named Chief Commercial Officer in March 2025.

Employee satisfaction remains high according to Great Place to Work certification, which shows that internally things are running smoothly despite the external drama.

Competitor Analysis

Looking at the competitive landscape, Harmony actually stacks up pretty well against peers in the biotech and specialty pharma space:

What jumps out here is Harmony's financial discipline compared to peers. Jazz has impressive revenue scale but relies much more heavily on debt (1.51 debt/equity vs Harmony's 0.35) and has lower margins. The other two companies are still losing money while Harmony's generating solid profits.

From both a financial health and strategic positioning standpoint, Harmony uses significantly less debt compared to these peers and maintains better operational metrics.

DCF, Analyst, & Value Opinion

Here's where things get interesting from a valuation perspective. Over the past three years, the company has consistently converted around 30-33% of its revenue into free cash flow - 32% in 2022, 37% in 2023, and 30.5% for 2024. This consistent conversion rate makes the company a good candidate for a DCF analysis.

The company maintains a stable share count thanks to its strong cash position and free cash flow generation, which reduces the need for dilution. This stability adds confidence when calculating a per-share value since the denominator (shares outstanding) is unlikely to change.

For my DCF analysis, I'm using a conservative 15% discount rate, which is slightly higher than the historical average return of the S&P 500. This conservative approach ensures the valuation remains realistic and reflects confidence that the company will outperform the market.

The "initial free cash flow" in my DCF model refers to the forecasted free cash flow for the next 12 months, not the past 12 months.

Bear case assumes an initial free cash flow of $210 million (a conservative estimate slightly below recent figures) with a 5% five-year growth rate and 3% terminal growth rate. This yields $38.07 per share with an IRR of 17% - still above the current market price.

Base case assumes an initial free cash flow of $230 million based on expected growth from current levels, with an 8% five-year growth rate and 5% terminal growth rate. This scenario yields $48.37 with an IRR of 20.5%.

Bull case assumes an optimistic initial free cash flow of $250 million, a 15% five-year growth rate, and 5% terminal growth rate. This case is justified by the company's strong free cash flow conversion, expected high revenue growth by analysts, and potential commercial launch of pipeline drugs. Results in $61.70 with a 25% IRR.

The fundamental metrics support a higher valuation too. Net margins above 20%, return on invested capital and return on equity both exceeding 20%, current ratio of 3.67, and that low 0.29 debt-to-equity ratio. The enterprise value to EBIT ratio has dropped from 74.3 in 2020 to 7.89 currently - that's historically cheap territory.

Analyst sentiment backs this up. Of 9 analysts covering the stock in the past three months, eight have strong buy ratings with price targets ranging from $31 to $70, averaging $51.44. Revenue projections show approximately $841 million expected in 2025 (18% growth) and $991 million in 2026 (around 38% growth from 2024).

Summary

Bottom line - I think Harmony Biosciences is a solid opportunity that's hiding in plain sight. The financial resilience is real, the pipeline has genuine potential, and the M&A-driven growth strategy is paying off. Yeah, they've got WAKIX dependency risk and some legal headaches, but show me a biotech company that doesn't have regulatory and legal risks.

What I'm watching for as catalysts: ZYN002 Phase 3 data in Q3 2025, progress on the Pitolisant HD development, and continued revenue growth from the core business. Warning signs would be any significant competitive threats to WAKIX, pipeline failures, or deteriorating cash generation.

The key question is identifying the company's catalyst - whether it will come from continued financial improvement or from successful FDA approvals and commercial launches of pipeline drugs. The future catalyst remains uncertain but will be critical in driving further valuation upside.

Long-term opportunity is substantial if they can successfully diversify beyond WAKIX while maintaining their financial discipline. New indications and regions for WAKIX, advancing that robust pipeline, geographic expansion, and opportunistic M&A all provide growth opportunities. At current valuations with 8 out of 9 analysts saying buy, this feels like one of those situations where Mr. Market is being overly pessimistic about a fundamentally solid business.

For investors comfortable with biotech risk and looking for exposure to the rare disease space, Harmony deserves serious consideration. The combination of current profitability, pipeline optionality, and conservative balance sheet management creates an attractive risk-adjusted return profile that's hard to find in this sector.

Nice write up, was looking forward to this one. How concerned are you about the class action? I can’t seem to find recent updates on it, doesn’t appear to have much press coverage. It makes me nervous though (having little biotech experience myself). Also looks like they settled a litigation with a competitor for a generic WAKIX drug, favorable to Harmony’s IP.