Super Micro Computer (SMCI): An Intriguing Play in the AI Revolution

15x PE with 50%+ Growth: The Most Overlooked Infrastructure Play in AI

TLDR

SMCI is an overlooked player in the AI infrastructure boom, trading at just 15x earnings despite 50%+ revenue growth. Recent accounting allegations have hammered the stock (down 66% YoY), potentially creating an opportunity for investors. The company's engineering-first culture, modular approach, and liquid cooling innovations have helped it capture 15.2% of the AI infrastructure market. While facing competitive pressures and supply chain risks, SMCI's operational efficiency ($3.66M revenue per employee) and expansion plans could drive 50%+ upside by 2027 if they achieve average industry FCF conversion.

Introduction

You've probably heard the old investing adage about the California Gold Rush: the real money wasn't made by the miners, but by the folks selling picks and shovels. In today's AI gold rush, SMCI is quietly selling some of the most advanced "shovels" in the business - and this company is doing something right.

In the sea of overpriced AI stocks, Super Micro stands out as a rational way to get exposure without paying absurd multiples. While everyone obsesses over Nvidia chips and OpenAI models, SMCI has been building the actual infrastructure that makes AI deployment possible.

The numbers are hard to ignore - SMCI is growing revenue by over 50% annually while trading at a PE of ~15. Most companies growing at that rate would command 30x+ multiples easily. They're outpacing legacy giants like Dell, HPE, and IBM who are stuck with single-digit growth.

The recent accounting allogations and market correction have created a perfect storm, with the stock down 66% over the past year. Not great if you've been holding, but potentially interesting if you're looking for an entry point and have some tolerance for volatility.

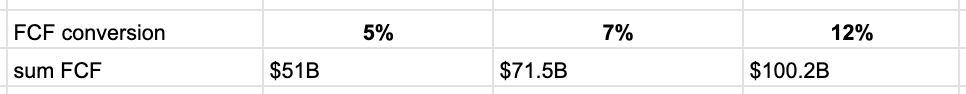

Valuing this company isn't straightforward. When I do a DCF for growth companies, I keep it simple and focus on key assumptions. If SMCI hits 2027 revenue estimates of $41.42B with an average FCF conversion around 7%, we're looking at potential upside of 50% from current levels.

Is it risky? Absolutely. The filing controversy isn't nothing, and competitors aren't going to roll over. But when I see a company with growing market share in AI infrastructure (15.2%), impressive operational efficiency ($3.66M revenue per employee vs HPE's $0.51M), and positioning in the right growth markets, it’s worth a second look.

In this analysis, I'll dig into what makes SMCI tick - from their engineering-first culture to their modular "building block" approach that's winning customers to their liquid cooling innovations. I'll examine the controversies while giving you the context needed to decide whether this beaten-down AI infrastructure play deserves consideration in your portfolio.

If you're interested in exploring stock opportunities like Super Micro Computer, Inc., you can check out my stock screening app here.

Company Overview

Founded in 1993 by Charles Liang, who remains the company's President, CEO, and Chairman today, Super Micro Computer started with a simple mission: building high-performance, efficient server and storage solutions. What began in Silicon Valley has expanded to a global enterprise with operations across the Americas, Europe, and Asia.

At its core, SMCI has positioned itself at the intersection of numerous transformative technologies shaping our future. They're deeply involved in AI, blockchain, server infrastructure, cloud computing, and 5G - either already dominating these spaces or rapidly gaining ground. This strategic positioning has allowed them to ride multiple waves of technological advancement simultaneously.

The company designs and manufactures application-optimized high-performance server and storage systems for a range of markets, including enterprise data centers, cloud computing, artificial intelligence, 5G, and edge computing. SMCI's comprehensive product lineup includes:

GPU-optimized systems for AI training and inference

SuperBlade® servers for high-density computing environments

Liquid cooling solutions that reduce energy consumption

Software-defined storage systems

Rack scale design solutions that optimize entire data center operations

The leadership team brings decades of experience, with founder Charles Liang setting the technical vision while David Weigand serves as CFO. This veteran leadership has helped SMCI navigate multiple technology cycles while maintaining its reputation for engineering excellence.

SMCI went public in 2007 on the NASDAQ with the goal of raising capital to fund investments in critical parts of the market - a move that has significantly contributed to their current success. In a testament to their growth and market significance, the company entered the S&P 500 and NASDAQ-100 in March 2024, driving impressive stock returns due to both their financial performance and the influx of capital from a broader range of investors.

Business Model & Market Position

What separates SMCI from the competition is its "building block" approach to system design. Rather than selling completely fixed configurations like Dell or HP, SMCI offers customers modular solutions that can be customized to their specific workloads while maintaining efficiency. The company's direct sales approach to large customers and its ability to rapidly incorporate new technologies like the latest GPUs from Nvidia gives it an edge in time-to-market.

SMCI operates primarily in the high-performance computing segment of the server market, with particular strength in AI infrastructure. Despite their size relative to some of their main competitors—HPE, IBM, Lenovo, Microsoft, Cisco, to name a few—they've established a meaningful reach in the market and have proven their dominance. In the global server market, they've solidified their position as one of the top three players.

The numbers tell a compelling story of their growing influence:

12.4% market share in enterprise computing

15.2% share in AI infrastructure

10.55% share in the overall server market for the 12 months ending Q4 2024

An impressive increase to 12.77% in the most recent quarter (Q4 2024)

This consistent expansion of market share demonstrates SMCI's increasing relevance and competitive edge in the server space.

The company has strategically expanded its manufacturing footprint with facilities in Silicon Valley, Taiwan, and the Netherlands, allowing it to balance production costs while maintaining quality control. Its recent expansion of Taiwan operations aligns perfectly with its growth strategy in AI server solutions.

The competitive landscape includes giants like Dell Technologies, HPE, and Lenovo, alongside specialized players such as Pure Storage. However, SMCI's focus on customization, rapid deployment, and cutting-edge technology integration positions it uniquely within this crowded field.

Past and Recent Controversy

While SMCI has demonstrated impressive growth and market positioning, the company has faced several controversies over the years that investors should be aware of. These incidents provide important context for understanding both the company's resilience and potential risk factors.

2018 Server Tampering Allegations

In 2018, Bloomberg published a bombshell report alleging that Chinese subcontractors, operating under the direction of the Chinese People's Liberation Army, had inserted malicious microchips into Supermicro's servers. According to the report, these compromised servers were then sold to various U.S. government departments and commercial clients.

Supermicro vehemently denied these allegations, and notably, the report was disputed by numerous other sources and companies named in it. When the news broke, Supermicro stated they had not been contacted by any government agencies and were unaware of any investigation. They proactively reviewed their motherboards for potential spy chips but found no evidence supporting Bloomberg's claims.

2006 Export Regulation Violation

In a less publicized but more definitive case, Supermicro pleaded guilty in 2006 to a felony charge for violating U.S. embargo regulations by selling computer systems to Iran. The company paid a $150,000 fine as part of their settlement. In their plea agreement, Supermicro acknowledged becoming aware of the investigation in February 2004 and subsequently established an export-control program that same year to prevent future violations.

2025 Financial Reporting Allogations and Hindenburg Report

Most recently and perhaps most relevantly for current investors, Supermicro has faced scrutiny regarding its financial reporting practices. Short-seller Hindenburg Research released a report in 2025 alleging accounting manipulation and questionable related party transactions. This report heightened market concerns about the company's financial transparency.

Around the same time, Supermicro experienced delays in filing its financial reports, which resulted in a non-compliance letter from Nasdaq. The company also identified material weaknesses in its internal controls over financial reporting—an admission that, while concerning, demonstrated a level of transparency.

Supermicro has firmly refuted Hindenburg's allegations of accounting manipulation while acknowledging the need to strengthen their internal controls. To address these issues, the company has:

Filed its outstanding reports to regain Nasdaq compliance

Hired additional financial personnel

Begun upgrading its IT systems to enhance reporting capabilities

These controversies highlight the importance of thorough due diligence when considering SMCI as an investment. While the company has successfully navigated these challenges thus far, they represent potential risk factors that could impact investor confidence and regulatory standing going forward.

Financial Performance

SMCI's financial performance has been nothing short of remarkable in recent years. For fiscal year 2024, the company reported total revenue of $14.99 billion, up from $7.12 billion in the previous year, representing impressive growth even before the current AI boom fully materialized. Gross profit reached $2.06 billion, showing the company's ability to maintain margins while scaling rapidly.

Historical Perspective

Examining SMCI's income statement since 2018 reveals a compelling transformation story. Between 2018-2021, performance remained relatively flat as the company established its foundation. However, the last three years have shown exceptional acceleration across all financial metrics.

This growth isn't limited to just the top line. We're seeing consistent improvement in gross, operational, and net income—a promising indicator that SMCI's expansion is built on solid fundamentals rather than just chasing revenue at any cost. This comprehensive financial strengthening suggests the company has found a sustainable model for growth that could continue into the future.

Margin Evolution

The company's net margin trend since 2018 tells a particularly interesting story about SMCI's financial discipline.

Margins have consistently improved year over year, with only a slight dip in 2024. This minor contraction was primarily driven by strategic investments in growth and capacity expansion—a calculated trade-off that positions the company for potentially even stronger future performance.

While this margin reduction isn't ideal in isolation, it represents an investment in future capabilities. If SMCI can return to its historical trend of margin improvement while maintaining its accelerated growth trajectory, the bottom-line impact could be substantial for investors.

Revenue Composition

The revenue breakdown provides additional context about where SMCI's growth is coming from:

What's particularly compelling about SMCI's financial profile is that it's achieved this growth while maintaining profitability—something many high-growth tech companies struggle with. The company's focus on operational efficiency has allowed it to expand production capacity without sacrificing bottom-line performance, creating a rare combination of rapid growth and financial discipline that investors should find attractive.

SMCI popped up while screening for high ROIC companies in the computer hardware industry. Check out the screener called ‘High ROI Hardware Hotlist’ if you’re interested.

Strengths & Growth Potential

SMCI's greatest strength lies in its engineering-first culture and ability to quickly adapt to new technologies. The company was among the first to offer systems optimized for Nvidia's H100 GPUs – the gold standard for AI training – allowing customers to deploy these precious chips efficiently.

Advanced Cooling Technology

The company's liquid cooling technology positions it well for the future of high-performance computing, where thermal management is becoming as important as raw processing power. As AI models continue to grow in size and complexity, the ability to cool systems efficiently will be a key differentiator.

In February 2025, SMCI announced a significant investment in a third campus in Silicon Valley specifically focused on R&D and manufacturing of liquid-cooled solutions. This move demonstrates their commitment to addressing a critical technical challenge in the industry.

From a technical perspective, CPUs and GPUs are commonly limited and throttled on personal computers due to thermal constraints. The same principles apply at data center scale, but with much higher stakes. Improving cooling capabilities will significantly enhance both the performance and longevity of current and future hardware—a competitive advantage that customers increasingly recognize as essential rather than optional.

Market Expansion Opportunities

Market expansion opportunities abound for SMCI, particularly in:

Edge computing deployments where efficiency and form factor matter

Hyperscale data centers seeking to reduce their cooling costs

Enterprise AI adoption that requires optimized infrastructure

International markets where SMCI is expanding its presence

As mentioned previously, their reach in the server and AI infrastructure market is only improving, demonstrating that the company is outpacing competitors. This creates a two-pronged growth trajectory:

Market Growth: Computing in general will only continue its upward trend, meaning even if SMCI simply maintains its current ~10% market position, growth is virtually guaranteed as spending in these sectors increases.

Market Share Expansion: Recent quarters show SMCI growing from 10% to higher shares of the total market. This proven ability to capture additional market share suggests significant future potential beyond just riding the wave of overall market growth.

Being positioned in a growing market with tailwinds rather than headwinds puts SMCI in an enviable position compared to companies in mature or declining industries.

Operational Efficiency

Looking at operational efficiency metrics reveals another SMCI advantage that's easy to overlook. Compared to closest competitors like HPE and Dell, which produce $0.51 million and $0.88 million per employee respectively, SMCI generates an impressive $3.6 million per employee. This extraordinary efficiency speaks to a lean operational model that can scale profitably—a crucial factor for sustained growth.

Strategic Partnerships

Strategic partnerships, particularly with Nvidia, have been crucial to SMCI's recent success. The company's ability to secure allocations of scarce GPU inventory has allowed it to satisfy customer demand when competitors couldn't deliver, further cementing customer relationships and reputation.

Future Growth Trajectory

Growth potential for the company looks promising based on current estimates for the next few years:

While I typically avoid putting too much weight on forward estimates, SMCI represents a special case. The company's value is heavily dependent on future growth expectations, and they have established a consistent pattern of meeting or exceeding these projections. Given this track record, the projected growth trajectory provides meaningful context for evaluating the company's potential.

Challenges & Risks

Despite its strong position, SMCI faces several challenges that investors should consider:

Competitive Pressures

The server market remains fiercely competitive, with larger players like Dell, HPE, and IBM able to leverage their scale and customer relationships. These companies are rapidly developing their own AI-optimized offerings and could pressure SMCI's margins.

SMCI must continuously innovate to maintain and grow its market share. While they've demonstrated impressive agility in bringing new technologies to market quickly, any slowdown in innovation could see them rapidly losing ground to larger competitors who are aggressively targeting the same high-growth segments.

Supply Chain Vulnerabilities

Supply chain constraints, particularly for key components like Nvidia GPUs, could limit SMCI's ability to fulfill orders. The company has been aggressive in securing inventory, but demand continues to outstrip supply industry-wide.

This dependency on scarce components creates a potential bottleneck that could impact growth if not managed carefully. While SMCI has navigated these constraints well so far, any major disruption could have outsized effects on their ability to meet customer demand.

Regulatory and Legal Concerns

SMCI has faced several legal challenges throughout its history that investors should be aware of. As mentioned in the controversies section, past issues like export regulation allogations and recent financial reporting concerns have created occasional headwinds for the company.

Additionally, as scrutiny of AI deployments increases, new regulatory frameworks could impact SMCI's business. As a provider of infrastructure rather than AI models themselves, SMCI's exposure is limited but not eliminated, particularly if regulations expand to include the enabling technologies of AI systems.

Customer Concentration and Reputational Risks

A significant portion of SMCI's growth is aligned with companies associated with Elon Musk, including Tesla and X.AI. This creates potential concentration risk, especially in light of recent events where consumer protests against these companies have occurred. Such controversies could impact these customers' willingness or ability to invest in new hardware, potentially affecting SMCI's revenue pipeline.

While customer diversification efforts are underway, any significant pullback from major customers could create short-term disruptions to SMCI's growth trajectory.

Technology Disruption

Technology disruption remains a constant threat, particularly if new computing architectures emerge that render current GPU-centric designs less optimal. SMCI's adaptability helps mitigate this risk, but investors should monitor emerging technologies carefully.

Quantum computing, specialized AI chips, or other alternative architectures could potentially challenge the dominance of current designs. SMCI will need to remain vigilant and ready to pivot as the technology landscape evolves.

Future Outlook

Analysts generally maintain a positive outlook on SMCI's prospects, with price targets ranging from $15 to $70, with a median of $50. While this range demonstrates some disagreement about valuation, it reflects consensus that the company's growth story remains intact.

Analyzing the Price Target Disparity

I would be willing to bet the wide range of price targets is a direct result of the recent financial filing controversy. Not to say it isn't a significant concern, but both the market and analysts have a habit of overreacting to situations like this. The company has taken concrete steps to address this weakness, and as these improvements take hold, we may see analysts at the lower end of the spectrum revise their targets upward.

This pattern of temporary overreaction to correctable issues often creates opportunity for investors who can separate short-term noise from long-term fundamentals.

Strategic Direction

The company's strategic vision centers on continued innovation in areas like liquid cooling, rack-scale design, and specialized AI systems. Management has outlined plans to expand manufacturing capacity to meet the surging demand, particularly in Taiwan where much of the AI supply chain is concentrated.

This focus on expanding production capacity while simultaneously pushing the technological envelope demonstrates management's understanding that SMCI must excel on both fronts to maintain its competitive edge in this rapidly evolving market.

Key Growth Catalysts

Looking ahead, SMCI is likely to benefit from several key trends:

Enterprise AI Adoption: As artificial intelligence moves beyond experimental phases into core business operations, demand for specialized infrastructure will accelerate. SMCI's expertise in building optimized systems positions them to capture significant value from this transition.

Energy Efficiency Focus: With data centers consuming ever-increasing amounts of power, efficiency has become a primary concern for operators. SMCI's innovations in cooling technology address this pain point directly, potentially making their solutions more attractive even at premium prices.

Edge Computing Expansion: As computing moves closer to data sources, the need for specialized, efficient systems at the edge will grow. SMCI's ability to design compact yet powerful systems gives them a foothold in this emerging segment.

Diversification of AI Accelerators: While GPUs currently dominate AI workloads, the ecosystem is diversifying with specialized chips from various manufacturers. SMCI's vendor-neutral approach and engineering flexibility should allow them to incorporate these new technologies quickly, maintaining their time-to-market advantage.

These catalysts, combined with SMCI's proven ability to execute rapidly in a fast-changing market, suggest that the company's growth trajectory could extend well beyond current projections, particularly if they continue to gain market share from larger, less agile competitors.

Valuation Analysis

Growth vs. Valuation Metrics

First thing worth mentioning is the exceptional growth in revenue this company has shown. A company that trades at a PE of ~15 and has grown the top line by at least 50% in the past three years is impressive. Most companies in today's market that grow at that rate trade at outrageous multiples.

Looking at SMCI relative to its competitors reveals some striking contrasts:

Competitive Advantages

Several metrics stand out when comparing SMCI to its larger competitors:

Market-cap Potential: SMCI's market cap is much lower than some of the larger players in the space, suggesting significant room for growth if they continue executing well.

Balance Sheet Strength: The current ratio suggests strong liquidity compared to competitors, which is helpful during periods of short-term turmoil or rapid expansion.

Growth Focus Over Dividends: Unlike the other three competitors listed, SMCI doesn't pay dividends. While this might deter income-focused investors, it signals the company's focus on reinvesting capital for growth—exactly what's needed for this investment thesis to work out.

Operational Efficiency: Their revenue per employee is nothing short of a flex. At $3.66 million per employee compared to HPE's $0.51 million, this tells me they're operationally efficient and gives me hope that margins in the future will look better than competitors.

R&D Efficiency: The R&D/revenue percentage spend is lower than competitors while delivering superior innovation. This suggests they're investing in the right areas of the market and doing so efficiently.

Capital Returns: As far as ROI, ROE, and ROA, they all look pretty good and efficient. A ROI (5-year average) greater than 15% is impressive, and if they can maintain that level, they're set up for a promising future.

DCF Valuation Approach

Taking a step back and attempting to value this company using a Discounted Cash Flow (DCF) model requires making some strong assumptions about future profitability.

Looking at a similar-sized competitor, HPE, and averaging their last 4 years of Free Cash Flow (FCF) and dividing it by their average revenue over the same period, I get a FCF conversion of ~7%. Let's consider this an average or typical FCF conversion percentage for the industry. Keep in mind FCF/Revenue percentages can vary widely based on how efficient a company becomes when it shifts focus to profitability.

Revenue estimates for 2027 are $41.42B. If SMCI can achieve an 'average' FCF/Revenue conversion of 7%, a market-cap increase of approximately 50% would be reasonable. For this analysis, I'm assuming a 5% growth rate for the first 5 years and a 2% terminal growth rate thereafter, which isn't a particularly aggressive assumption given the company's historical performance.

2027 Scenarios - $41.42B revenue

[5-year growth - 5%, terminal growth - 3%, 12% discount rate]

Looking further ahead to 2035, let's imagine SMCI achieves revenues similar to Dell today (~$95B). Using the same growth assumptions from that point forward, the resulting valuations would represent compound annual growth rates of 9.8%, 13.5%, and 17.4% respectively from the current market cap.

2035 Scenarios - $100B revenue

[5-year growth - 5%, terminal growth - 3%, 12% discount rate]

Regarding the discount rate of 12%, I would typically apply a higher rate for an analysis based purely on future performance, but the risk can be viewed from many angles. I prefer to keep the analysis straightforward rather than getting caught up in debates about whether the discount rate should be 12% or 15%, or whether the FCF/Revenue conversion will be 3% or 12%.

Share Dilution Considerations

It's important to note that SMCI has increased their share count by approximately 1% per year on average. In 2018 they had 493M shares outstanding, which grew to 555.88M by 2024. While not ideal, I would consider this a relatively low dilution rate compared to other high-growth companies. This moderate dilution helps fund investments for growth without excessively penalizing existing shareholders.

Alternative Valuation Perspectives

It's definitely challenging to value this company based on traditional DCF methods. SMCI's main focus hasn't been converting revenue or earnings to FCF, but rather growing and establishing market dominance.

An alternative approach worth considering is examining how the market values other high-growth companies. If you look at companies in attractive industries that grow at rates similar to SMCI (50%+ year-over-year), they typically command PE ratios of 30 or higher. So if the market forgives the company's recent accounting violations and focuses on its exceptional growth, I wouldn't be surprised to see SMCI trading at a PE of 30 or higher, which would represent a 2X increase from current levels.

While I generally prefer not to value investments based on potential multiple expansion, this phenomenon occurs regularly in growth-oriented markets and represents a plausible upside scenario for SMCI shareholders.

Chart Analysis

Looking at a chart of SMCI doesn't exactly inspire confidence at first glance. The stock has been hammered from multiple directions recently, creating what appears to be a perfect storm for shareholders:

Down approximately 66% over the past year

About 37% lower in just the past month alone

This dramatic decline stems from a dual impact: the company's filing controversy creating uncertainty around financial reporting practices, combined with a broader market correction that has been particularly harsh on technology stocks.

The technical picture reflects this challenging environment. Most moving averages and technical oscillators currently sit in neutral territory—not surprising given the sharp decline followed by a period of consolidation. Key technical indicators show:

Price trading below both the 50-day and 200-day simple moving averages (SMA)

Relative Strength Index (RSI) hovering in the neutral region

This technical positioning is often characteristic of stocks that have experienced significant selling pressure but may be approaching levels where value-oriented investors begin to take interest. The neutral RSI suggests the stock is neither deeply oversold nor showing signs of momentum-driven recovery yet—essentially in a "wait and see" mode as the market digests both the company-specific issues and broader market dynamics.

Summary & Conclusion

Super Micro Computer represents an attractive way to invest in the AI infrastructure boom without paying premium valuations commanded by chip designers. The company's engineering-led culture and specialized product lineup position it well for the continued expansion of AI deployments.

Key Investment Thesis

The case for SMCI rests on three points:

Sustained demand for AI infrastructure will drive server growth for years

Specialized designs and quick time-to-market provide competitive advantages

Current valuation offers a reasonable entry point given growth prospects

Market Position

This relatively new entrant has grown impressively compared to legacy giants like Dell, HPE, and IBM who struggle with single-digit growth. SMCI has captured significant market share and continues expanding—suggesting both their technological approach and execution model are working.

Risk/Reward Perspective

SMCI offers an attractive risk-reward profile for investors seeking AI exposure with less hype. The company's proven execution and expanding manufacturing capacity address key concerns, though investors should be prepared for volatility and size positions accordingly.

Final Thoughts

In the AI gold rush, SMCI is selling some of the most advanced shovels—and selling them faster and more efficiently than many competitors.

I'm not a holder, nor do I support or defend past violations. I found this while screening for high ROIC companies and decided to do a deeper dive, as I often do with companies. This is for educational purposes.

Really interesting point about how SMCI's vertical intgration gives them an edge in the AI server market. I think a lot of investors overlook how much the hyperscalers need customized cooling solutons for these GPU dense racks. The margins might be lower than pure software plays, but the capital efficiency story is pretty compeling when you look at their asset turnover. Do you see any risks from the newer entrants trying to compete on the liquid cooling side?